US Bank Layoffs Today: What's Happening And How It Affects You

Alright folks, let's get real here. If you've been keeping up with the news, you probably already know that the banking industry isn't having the best year. The term "US bank layoffs today" has been popping up everywhere, and it's enough to make anyone anxious. Whether you're an employee in the financial sector or just someone with a savings account, this is big news that affects all of us. So, let's dive into what's happening and why it matters.

Now, I know what you're thinking—"why should I care about some big banks firing people?" Well, here's the thing: banks are like the backbone of our economy. When they're struggling, everyone feels the ripple effects. From job losses to changes in banking policies, it's not just about the employees getting laid off—it's about the bigger picture.

Before we get into the nitty-gritty details, let's clear something up. This isn't just about one bank. We're talking about a trend that's affecting multiple financial institutions across the United States. So, buckle up because we're about to break it down for you in a way that makes sense—even if you're not a finance expert.

Read also:Kaylee Hartungs Journey Through Eye Surgery A Comprehensive Guide

What Are US Bank Layoffs Today All About?

Let's start with the basics. When we talk about "US bank layoffs today," we're referring to the recent wave of job cuts happening in the banking industry. But why is this happening? Well, there are a few key reasons:

- Economic uncertainty: The global economy has been a bit rocky lately, and banks are feeling the pressure.

- Technological advancements: Automation and AI are changing the way banks operate, making some jobs obsolete.

- Shifting consumer habits: More people are using online banking, which means fewer branch employees are needed.

These factors combined are leading to some pretty significant changes in the banking world. And unfortunately, that means a lot of people are losing their jobs.

Why Are Banks Cutting Jobs?

Now, let's talk about the "why" behind these layoffs. It's not just about saving money—although that's definitely a big part of it. Banks are also trying to adapt to a rapidly changing landscape. Here's a closer look at some of the reasons:

Economic Downturn: The economy hasn't been the most stable lately, and banks are feeling the pinch. With interest rates fluctuating and loan demand decreasing, banks are looking for ways to cut costs. And unfortunately, that often means cutting jobs.

Technological Shifts: Technology is advancing at lightning speed, and banks are no exception. Automation and AI are replacing jobs that were once done by humans. From chatbots handling customer service to algorithms processing loans, the need for human employees is decreasing.

Changing Consumer Behavior: More and more people are banking online these days. With the rise of mobile banking apps and digital wallets, there's less need for physical branches. That means fewer tellers, branch managers, and other roles that were once essential.

Read also:Will Dan And Serena Get Back Together Exploring The Possibilities

Who Is Being Affected?

So, who exactly is feeling the impact of these layoffs? It's not just one group of people. From entry-level tellers to high-level executives, no one is immune. Here's a breakdown of who's being affected:

Entry-Level Employees

Let's start with the folks at the bottom of the ladder. Tellers, customer service reps, and other entry-level positions are some of the hardest hit. Why? Because these roles are often the easiest to automate. With self-service kiosks and chatbots taking over, there's simply less need for human interaction.

Mid-Level Managers

Next up, we have the mid-level managers. These are the folks who oversee branches and departments. As banks consolidate operations and move towards digital solutions, many of these roles are becoming redundant.

Executives and Specialists

Even those at the top aren't safe. Executives and specialists in areas like risk management and compliance are also feeling the heat. With regulations changing and technology advancing, some of these roles are becoming obsolete.

How Many Jobs Are We Talking About?

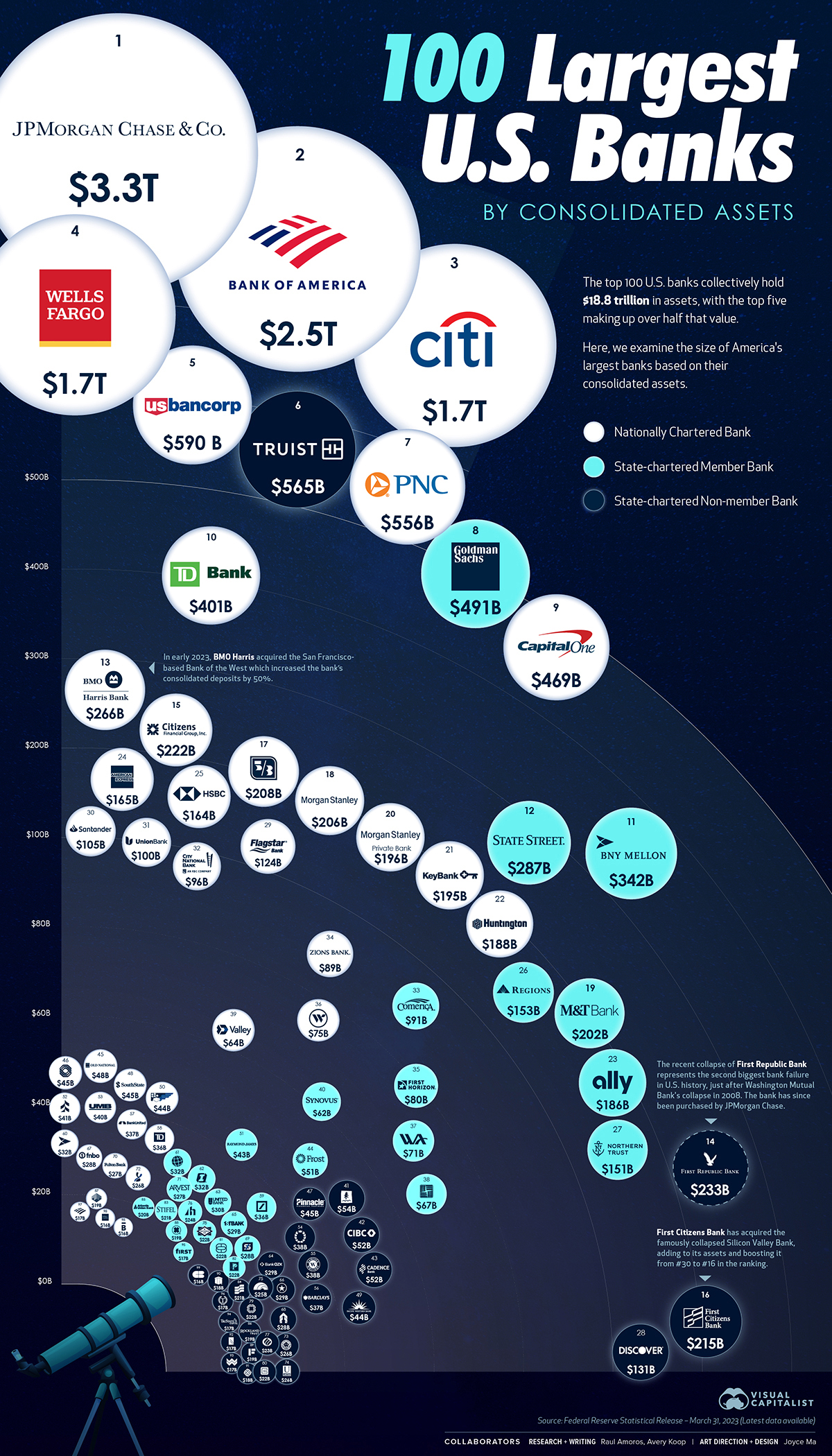

Alright, let's talk numbers. Just how many jobs are we looking at here? According to recent reports, major banks like JPMorgan Chase, Wells Fargo, and Bank of America have announced plans to cut thousands of jobs. And that's just the big players. Smaller banks and credit unions are also feeling the pressure.

But here's the kicker: these numbers are likely to grow. As more banks adopt new technologies and streamline operations, we can expect to see even more layoffs in the coming months.

What Does This Mean for the Economy?

Now, let's talk about the bigger picture. How do these layoffs affect the economy as a whole? Well, it's not all doom and gloom. While job losses are never a good thing, there are some potential silver linings:

- Increased efficiency: With automation and AI, banks can operate more efficiently, which could lead to lower costs for consumers.

- Job creation: While some jobs are disappearing, new roles are being created in areas like tech and data analysis.

- Economic restructuring: As industries evolve, the economy as a whole becomes more dynamic and adaptable.

Of course, there are also some downsides. Unemployment rates could rise, and those who lose their jobs may struggle to find new ones in a rapidly changing job market.

How Can Employees Prepare?

So, what can employees do to protect themselves in this uncertain climate? Here are a few tips:

- Upskill: Consider taking courses or certifications in areas like technology and data analysis. These skills are in high demand and could make you more valuable to employers.

- Network: Don't underestimate the power of a strong professional network. Reach out to colleagues, former coworkers, and industry contacts to stay informed about job opportunities.

- Stay informed: Keep up with industry news and trends. The more you know, the better prepared you'll be for whatever comes your way.

Remember, change is inevitable. The key is to adapt and stay ahead of the curve.

What About Consumers?

And what about the rest of us? How do these layoffs affect everyday consumers like you and me? Well, there are a few things to keep in mind:

Banking Policies: With fewer employees, banks may need to change their policies. This could mean longer wait times, fewer branch hours, or even changes to fees and services.

Customer Service: As more tasks are automated, customer service may become less personal. If you're used to speaking with a real person when you have questions, you might find yourself dealing with chatbots more often.

Product Offerings: Banks may also start offering fewer products or services as they streamline their operations. This could mean fewer loan options or less personalized banking experiences.

What Can Consumers Do?

So, what can we do to protect ourselves as consumers? Here are a few tips:

- Shop around: Don't be afraid to compare rates and services between different banks. You might find a better deal elsewhere.

- Embrace technology: If you haven't already, start using online and mobile banking. It's often faster and more convenient than visiting a branch.

- Stay informed: Keep an eye on your bank's policies and fees. If something changes that you don't like, don't hesitate to speak up or switch to a different bank.

At the end of the day, it's all about being proactive and informed.

What Does the Future Hold?

So, where do we go from here? The future of banking is uncertain, but one thing is clear: change is coming. Here are a few predictions for what we might see in the coming years:

- More automation: As technology continues to advance, we can expect to see even more automation in the banking sector.

- Increased focus on digital solutions: With more people banking online, banks will likely continue to invest in digital platforms and services.

- Shift in job roles: While some jobs will disappear, new roles will emerge in areas like data analysis, cybersecurity, and AI development.

It's a brave new world out there, and the banking industry is right in the middle of it.

Conclusion

Alright folks, that's the scoop on "US bank layoffs today." It's a complex issue with far-reaching implications, but hopefully, this article has helped you make sense of it all. Remember, whether you're an employee or a consumer, the key is to stay informed and adaptable.

So, what can you do next? If you're an employee, consider upskilling and networking to stay ahead of the curve. If you're a consumer, keep an eye on your bank's policies and don't be afraid to shop around for better deals.

And finally, don't forget to share this article with your friends and family. The more people know, the better prepared we all are for whatever the future holds. Thanks for reading, and stay tuned for more updates on the ever-changing world of finance!

Table of Contents

US Bank Layoffs Today: What's Happening and How It Affects You

What Are US Bank Layoffs Today All About?

How Many Jobs Are We Talking About?

What Does This Mean for the Economy?